Attribute Investor

As an entrepreneur who comes from a long line of successful entrepreneurs, is married to an incredible entrepreneur, and mentors brilliant upcoming entrepreneurs – I know the qualities and attributes one must possess, in order to be successful in business.

In recent years I’ve expanded my interests into becoming what I’ve coined as an Attribute Investor - meaning I base my investment decisions on whether the entrepreneur possesses a particular set of attributes, rather than their business pedigree.

This investment approach is radically different to any venture capitalist, angel investor, or private equity investor you’ll find. My guiding principle is that you must win my heart to gain access to my treasures. This is more than just financial capital – it’s also my generosity and wealth of experience as a mentor. I support my investments to monetize their bliss in creative ways, and create Asset Wealth playbooks that result in true wealth creation and even greater joy.

I invest in both start-ups and mature businesses across all industries. My passion is for businesses in the $1-$10mm annual revenue range, though I won’t shy away from businesses with the potential to greatly exceed this.

A firm believer in transparency, honestly, and integrity, I’m proud to share the details from my investment to date.

For more information about mentorship and investment support, I invite you to apply to speak with me.

ASSET INVESTMENTS

Bliss Yacht in Austin

Our newest acquisition is our sexiest to date. We are currently constructing the Bliss Yacht, an 85-foot luxury vessel with nine state rooms and enough bling to make anyone blush. This multimillion-dollar vessel will be ready by Summer 2022. We will be utilizing the vessel for personal development and corporate retreats, as well a private events and short-term vacation rentals. This will be the very first Luxury Lake Yacht ever moored in any body of water in the state of Texas.

Bliss Villa in Destin

Our most recent real estate asset acquisition is a beachfront villa in the coveted neighborhood of Crystal Beach in Destin Florida. This residential real estate asset was acquired for $3.45 mm. It will be offered as a short-term vacation rental and as a fantastic site for personal development and corporate retreats.

Bliss Island Resort in Hawaii

During the early throws of the COVID, I went hunting for the perfect property to fulfill my lifelong dream to own, operate and live at the perfect island property for transformational personal development retreats. Prior to the purchase, I nicknamed the “someday acquisition” Necker West, in homage to the fabulous Necker Island property owned by my favorite entrepreneur Sir Richard Branson. I found it on sale during the carnage of the Pandemic, acquiring the property for the ridiculously low price of $2.9 mm. After just one year, and with the help of a timely real estate boom in Hawaii, the property has nearly doubled in value to $5.5 mm. This one is a keeper though, so no plans to sell it anytime soon. I run all of my own personal development retreats (www.BlissChampions.com) here and invite my colleagues in the personal development industry to do the same (www.blissisland.com).

889 Winslow Development in Silicon Valley

In 2015, my wife and I took a huge leap of faith acquiring two dirt parking lots attached to our Fox Theatre parcel in downtown Redwood City, CA for $2.1 mm. We attached the three parcels into one, then attracted an experienced local developer to partner with for a development. We agreed to build a mixed-use building of office and retail on spec. This means we did not have any anchor tenants prior to construction. It took a little over two years to get the project approved by the City of Redwood City and a full year to build. Before construction was even completed, we were able to lease up 100% of the office space on long term leases and most of the group floor retail space too. This created enormous returns for our investment group, who invested $64 mm into the project. Less than one year after construction was completed, we were offered $135 mm for the property. Our ownership group chose to maintain majority ownership but took enough chips off the table to make all of our investors extremely happy. Proceeds from the sale of equity allowed us to create our first Opportunity Zone funds, paving the way for multiple real estate acquisitions in Hawaii, Texas, Alabama and Florida.

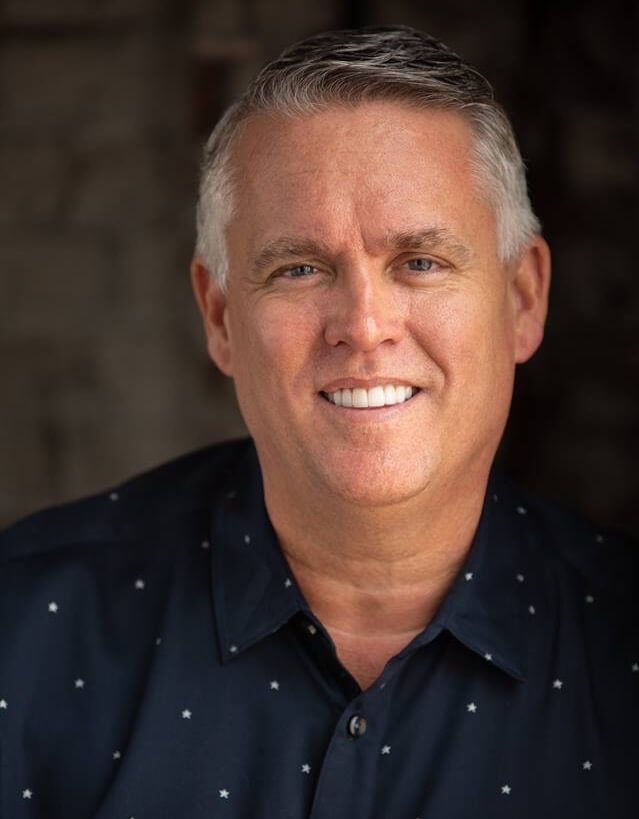

Fox Theater in Silicon Valley

In 2010, my wife and I acquired the Fox Theater property in downtown Redwood City. We utilized an SBA loan to purchase the property out of foreclosure for $6 mm. The property consisted of 40,000 square feet of mixed-use office, retail and entertainment space. Most real estate investors were scared away by the theater portion, which had a historical designation and could not be converted or torn down. We saw nothing but opportunity. After renovating and securing tenants for all the empty retail and office spaces, my wife and I put our entrepreneurial skills to the test by starting a concert promotions company called Golden Fox Venues Inc. to become the tenant of the theater. This entity would go on to do over $25 mm in revenue from concert ticket sales and venue rentals. Along the way, it would also provide some of our most exhilarating goosebump moments. We would meet and host titans of industry, world-famous artists, best-selling authors, and every politician of consequence in the state of California. Some of our highlights included meeting sitting President Barack Obama and Oprah Winfrey backstage before they performed on our stage. After just seven years of ownership, we sold the asset for $18.5 mm and earned an additional $500k on a carry back note from the buyer, bringing our total exit to $19 mm. That’s a 300% return on an asset nobody wanted and bankrupted its previous owner.

Golden State Theatre in Monterey

My wife and I were doing so well with our investment in the Fox Theater property, we decided to take a second leap of faith purchasing the financially insolvent Golden State Theatre in downtown Monterey, CA. Again, we utilized an SBA loan to acquire this asset for $3.95 mm. The mixed-use property consists of 28,000 square feet. Building on the experience we gained owning and operating the Fox Theatre, we quickly got this property cash flowing profitably as a real estate asset and as a live entertainment venue. By the close of our second year of ownership, it became the premier live entertainment and rental venue on the Monterey Peninsula pulling in over $2mm annually in concert revenue. After the COVID Pandemic put all concert venues on hold world-wide, we miraculously found a buyer for the property, selling it for $4.5 mm in June of 2021. Not our biggest exit but certainly our luckiest. After ten years of operating concert venues and putting on over 1000 private events and publish concerts, we have officially retired from this lucrative combination of theatre ownership and venue management. Combining the Fox and Golden State theaters, we purchased them for $9.95 mm and exited them for $23.5 mm. We know of no other theater owner in the United State that achieved this level of financial success from the ownership of historic theater properties. In fact, there use to be over 2,000 theatre in America and there are now less than 250. We certainly did our part to keep two very cool ones alive and well.

BOA VIDA WINE ESTATE IN SILICON VALLEY

We acquired this beautiful 5-acre wine estate in 2016 for $3.3. In addition to becoming our home for four years, its thousand vines produced enough grapes to make enough quality wine to service all the wine needs of our theater patrons. It cost roughly $9 to produce a case of wine, which we would then sell by the glass for $12. This vertical integration into our other businesses made this property nearly free to own, sparking a desire to repeat this result again and again. We sold the property during COVID in less than 48 hours for $3.75 mm. Our motivation for selling was to move out of Californi

I work with only a select handful of entrepreneurs at any given time. If you’re a successful, revenue-focused entrepreneur looking to create true personal wealth without needing to rely on increasing your top-line revenue, I invite you to apply to speak with me.